Measure results

Close the loop between campaign performance and actual marketing results

Marketing CFOs will love

Cardlytics’ campaign reporting is the gold standard

With insight into bank transaction data, we report our exact impact on sales.

There is no need to estimate performance. These are real purchases, made by real people who saw ads in our platform.

Also important, we report on both online and in-store sales. This enables marketers to accurately track ROI regardless of where customers decide to buy.

Measure impact, not just sales

We help marketers understand the effectiveness of every dollar they spend on our platform. Commonly requested post-campaign reports include:

Quantify sales lift and incremental return

Track whether customers continue to buy

Measure the impact on market share

Test vs. Control

We’ve set up a rigorous test vs. control process to answer three questions every marketer wants to know:

Through our partnerships with top banks in the US and UK, we see over $4.1T in consumer spend. We use this data to evaluate customer purchases, and accurately measure a campaign’s true incremental sales impact.

Access to third-party measurement through Nielsen

Nielsen Sales Lift Measurement calculates and reports the incremental sales lift of Cardlytics campaigns.

Long-Term Value

Long-Term Value reporting sheds light on campaign impact beyond the initial flight.

We look at the purchase patterns of people who converted from the original campaign to measure their continued loyalty to the marketer’s brand – specifically, how many more times they purchase and how much they spend.

Share Shift

Customers have seen the ad and made a purchase. But are marketers actually gaining share from competitors?

With Share Shift analysis, we help brands understand how their customers’ behavior is changing in their category, and if they’re picking up share from their competitive set.

“Cardlytics’ unique targeting capabilities ensure we can acquire new customers and redirect competitive spend to Marriott. The customer experience means that there is no perception of discounting for our brand.”

Lauren Profeta

Portfolio Partnerships Manager, Europe, Marriott Hotels

IDENTIFY OPPORTUNITY

Connect the dots with Purchase Intelligence

Insights into bank transaction data power Cardlytics campaigns from start to finish. Beyond helping marketers measure performance, we also use purchase intelligence to identify the best prospects and target ads on our platform.

Learn more about finding and reaching the right audienceREACH REAL PEOPLE

Create a tipping point to win the next sale

Our native ad platform in banks’ digital channels reaches consumers as they manage where they’ll spend and save. When customers weigh whether to buy from one store or another, relevant, targeted offers can change their purchase decisions.

Learn more about our ad platform

Research & Insights

View all

UK Loyalty Movement Report: Retail

Introduction

In our previous report, Redefining Customer Loyalty, Cardlytics defined loyalty as a consumer’s preference for a merchant over its competitors, analysing spending across six industries to measure customer loyalty and spending patterns with both loyal and non-loyal customers.

But customer behavior isn’t fixed - customers shift between loyalty segments over time. Understanding these shifts helps identify churn and informs strategies to nurture relationships and move customers to higher loyalty segments. In our UK Loyalty Movement Report, we dive into customer behavior in the Retail category to better understand engagement over time by analyzing more than £245 billion in consumer spend behavior.*

Retail Category Loyal Customers

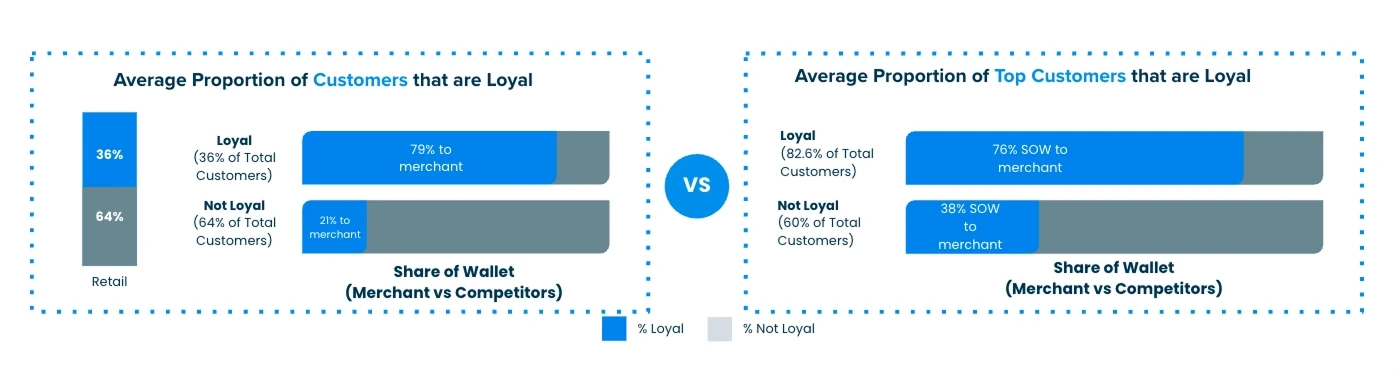

On average, 64% of a merchant’s customers are not actually loyal. But the loyal segment has a much higher share of wallet (79%) than a not loyal segment (21%).

Top Customers (top 20% of most frequent transactors) show a strong uptick as loyal vs not loyal customers. But the loyal customer segment shows more than 3x higher share of wallet.

Findings

We looked into purchase data across Retail in the UK over the last 8 quarters (Q1-23 through Q4-24) on a quarter by quarter basis to see whether even the “most loyal” customers showed changes in their purchase behavior.

Retail Loyalty Movement

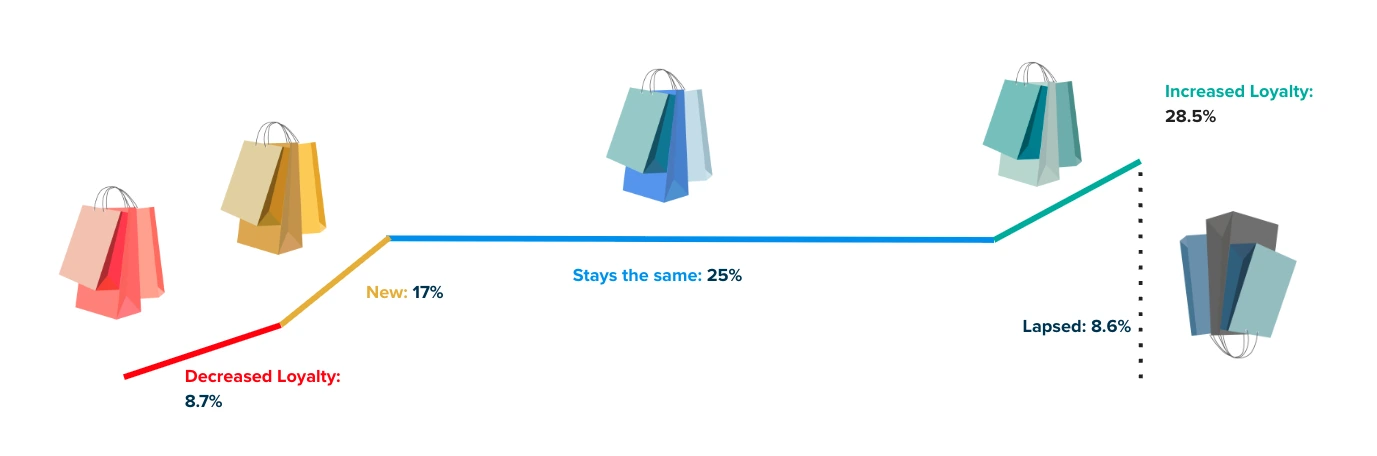

Overall, quarter over quarter, 25% of customers tend to remain in their existing segments while 37.2% increase or decrease their loyalty to a merchant. Yet there is much more extensive customer loyalty movement within the “not loyal” segments.

Segment movement

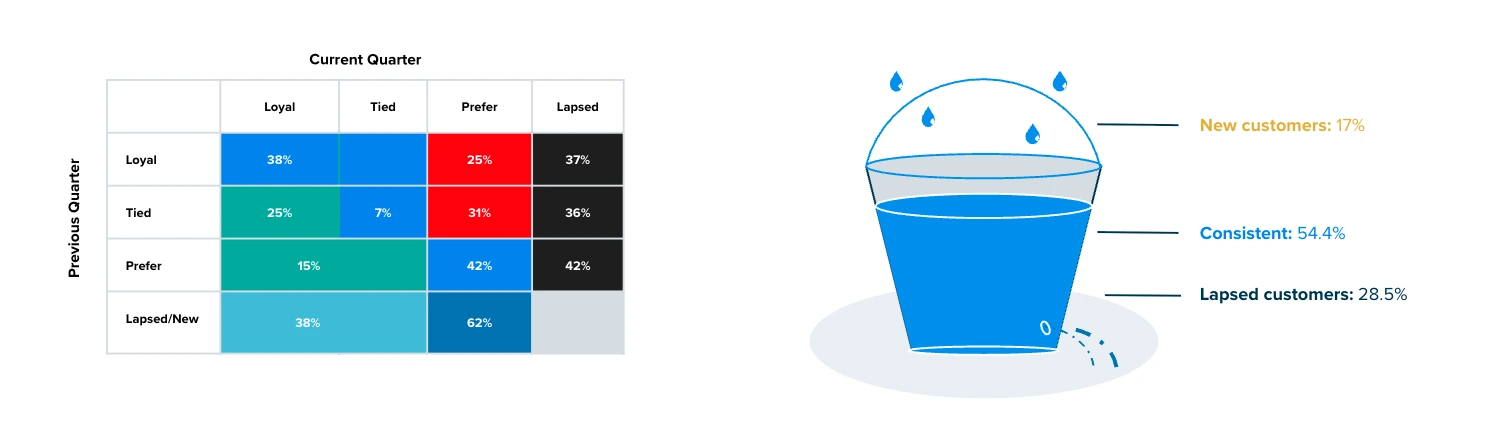

The Tied segment (part of the Not Loyal group) demonstrates the most volatility — with just 7% remaining stable and 29% moving up and 29% moving down into other segments.

Retail Leaky Bucket

Retail brands are acquiring new customers yet even more existing customers are moving into the lapsed tier. This cycle can be reversed by continuing to nurture existing customers.

Diving deeper into the individual segments tells us:

- Loyal customers and those that Prefer the competition are the most stable segments, with 38% and 42% respectively staying in the same category from one

quarter to the next. This indicates a strong commitment to brand preference — whether for your brand or a competitor's. - Customers in the Tied segment exhibit the highest level of movement, with just 7% remaining Tied quarter-over-quarter. These shoppers are the most susceptible to influence and represent a key opportunity for brands aiming to tip the scales in their favour.

- Interestingly, Loyal customers still show a 25% lapsed rate, which is comparable to the Tied segment’s 36% lapsed rate. This suggests that attrition among Loyal customers may not be driven by brand disengagement, but rather by natural gaps in purchase cycles — for example, customers who buy apparel less frequently.

Definitions of Customer Segments

Loyal Customers:

- Loyal: Only shop with a specific brand, or have the highest share of wallet with a given brand and relative rank is lower than all other brands in consideration set

Not Loyal Customers:

- Tied: Similar relative ranks to 2 or more brands regardless of share of wallet ranking

- Prefer: Lower share of wallet and higher rank than other brands in their consideration set

- Lapsed: Shopped historically but do not shop currently, as defined by the analysis time period

- New: Shop currently but have not shopped historically, as defined by the analysis time period

Takeaways

Marketers know it’s more costly to acquire or re-acquire customers than to keep existing ones engaged. When brands neglect current customers, they risk losing them and undoing past investment yet the reasons why a customer might “lapse” is different depending upon their loyalty tier. Loyalty is fragile and demands ongoing effort as competition is always close by. To stay top of mind, marketers must continuously nurture relationships, understand customer needs, and offer seamless experiences. To foster loyalty with your customers, consider these recommendations:

- Use an “always on” strategy to keep customers engaged, regardless of purchase

frequency. - Regularly update/refine customer segments and adjust reward offers to keep

them engaged. - Use targeted campaigns to boost loyalty and revenue.

Cardlytics can deliver a comprehensive Customer Loyalty Analysis with insights into customer behavior and movement across defined loyalty segments. Contact us for more details.

* For this report, we've selected the entire retail category in our data, collectively representing over £245bn in annual card spend. This sample differs from the previous Customer Loyalty Analysis report.

"If the price is right"

New Cardlytics State of Spend study reveals tentative recovery in consumer confidence

After two years of post-pandemic recalibration, UK consumers are shopping again – just not like they used to.

The latest data from Cardlytics reveals a retail landscape defined less by indiscriminate demand and more by considered choice.

While spending remains resilient in many categories, shoppers are now clearly applying more scrutiny to how and where they spend. Value, convenience, and perceived quality are under the microscope, and if expectations aren’t met, consumers are pulling back.

This divergence is playing out differently across the retail sector. Categories like high-street fashion and beauty are holding strong, buoyed by brand loyalty, reviving high streets, and the occasional feel-good purchase.

But grocery and household tell a more precarious story, where price sensitivity and shifting shopping habits are forcing brands to work harder and smarter to keep customers loyal.

Whether shopping in-store, online, or through delivery apps, today’s consumer expects more than just competitive pricing.

They’re looking for value that feels personal. For retailers, the challenge is clear: speak directly to customer priorities, or risk being left behind.

Retail: A resilient core – but rewards go to relevance

Fashion and beauty continue to defy broader economic headwinds. Spending on make-up and beauty products surged by 19% year-on-year in Q1 2024, and growth has carried into 2025, albeit at a more modest 5%. The number of transactions in the sector has outpaced spend, suggesting that while shoppers remain engaged, they are consciously managing budgets – opting for smaller, more frequent purchases that still offer a sense of indulgence. It’s a pattern that reflects the so-called “lipstick effect”: the tendency for consumers to turn to affordable luxuries during uncertain times.

High street fashion is also faring well. After growing 9% in 2024, the category recorded a further 5% uptick in early 2025, driven by established brands with a strong physical presence and a loyal customer base. This comes despite recent cyber attacks on major retailers, which - in good news for the sector - hasn’t deterred shoppers as of yet. Rather than stop spending, it just shifted it - as shoppers showed they are loyal to their habits over individual brands.

Online fast fashion, meanwhile, showed little momentum through 2024, but increased sharply in Q1 2025 with a 13% rise in spend. Discount-led promotions and trend-led buying may be drawing cautious consumers back to basket - but this trend remains nascent stages.

However, not all categories are experiencing this trend. Department stores saw a 4% drop in spend in 2024, with a further 5% decline in 2025. Transactions have followed the same downward trajectory, pointing to a broader shift away from traditional department store formats. As shoppers prioritise experience, value and, crucially, brand alignment, department stores may be losing relevance to more focused propositions.

Cardlytics Analysis

Retailers that combine physical presence with a strong sense of brand identity continue to perform strongly. But brands can no longer rely on habitual customer loyalty. Our data shows clear momentum for brands that are giving customers a feel-good factor to shopping, whether that be through price, experience or personalisation.

Case Studies

- A leading e-commerce & retail brand partnered with CDLX to drive new customers and ensure incremental revenue, by leveraging CDLX’s pay-per-performance channel to incentivise spend from competitors via cash back reward. The campaign delivered £1m revenue across 20K redemptions, captured 27% SoW across redeemers from competitors. Across the “New” segment, CDLX captured 77% SoW from competitors.

- A major European health & wellness brand partnered with CDLX to acquire new customers, re-engage and retain lapsed and existing customers, and drive sales over a six week period in Q1 2025. Leveraging our proprietary transaction data into data-driven marketing, the campaigns drove over £2M Revenue and an average ROAS of £24.41. During that period, the brand increased share of wallet by 52%, crucially gaining ground on key competitors in the health and wellness industry.

Grocery: Essential, but under pressure

Supermarkets remain a staple of consumer spending, but the data tells a story of growing caution. After recording 9% growth in 2024, so-called ‘big grocers’ saw a 3% fall in spend in the first quarter of 2025. The number of transactions have held steady however, suggesting that shoppers are still showing up – they’re just spending less when they do.

This theme appeared prominently across convenience grocery.

Spend rose by 11% in 2024, before dipping 4% this year. Unlike the supermarkets, however, transaction volumes declined modestly, pointing to a broader behavioural shift. Shoppers appear to be planning more carefully, opting for fewer top-up trips and returning to larger, weekly shops.

In contrast, grocery delivery continued to grow, extending its gains from last year. After a 16% rise in 2024, the category saw a further 13% increase in early 2025, with both the average transaction value and number of orders increasing. Once considered a pandemic-era habit, online grocery ordering now looks like a lasting behavioural shift – particularly for customers who value predictability, convenience and the ability to budget in advance.

Cardlytics Analysis

The return of the big weekly shop, combined with the decline in spontaneous convenience visits, signals a shift towards planned, value-driven behaviour. For grocers, this is both a challenge and an opportunity.

The ability to personalise offers, reinforce loyalty, and remove friction at checkout is becoming critical, particularly as shoppers become more deliberate in how and where they spend. Cashback rewards can help bridge the gap between price expectations and perceived value, especially when tailored to individual behaviours. Delivery providers are responding well to this shift, offering consistent, low-surprise experiences that support budgeting and convenience. A similar customer-first approach is increasingly expected in-store, where value and planning now take precedence over impulse.

Case Study

A leading food delivery platform and CDLX partnered to drive new customer acquisition and incremental revenue, using cashback rewards to incentivise spend from competitors.

The campaigns delivered 119K redemptions and £2.9M in revenue, capturing 44% share of wallet across lapsed and acquisition segments. Incremental revenue from the "New" customer segment alone reached £470K, with repeat customers generating an additional £7.2M in spend post-campaign.

Household: Still spending, but pulling back

After a period of steady post-pandemic investment in the home, household spending is beginning to cool. While consumers are still investing in their living spaces, they are doing so with increasing caution – prioritising essential upgrades over discretionary improvements. Across all categories, the number of transactions has remained broadly stable, but average spend is softening – indicating a shift towards smaller, more deliberate purchases.

This was the case for DIY, which saw spend increase modestly by 4% in 2024, before falling 1% in early 2025. Transaction volumes held steady, but average spend edged down – showing that consumers are now focusing on smaller-scale fixes or improvements, rather than large projects.

Value homeware followed a similar pattern, emphasising the importance of affordability in the household goods sector. While total spend softened, the number of transactions held firm, showing a consumer preference for incremental upgrades that deliver a sense of progress without straining budgets. Elsewhere, spending on garden and outdoor products declined in early 2025, reflecting a clear pivot towards core priorities, with seasonal or aspirational purchases falling by the wayside.

Spend for electricals declined by 6% in 2025, alongside a 7% fall in transactions. But average spend rose 6%, suggesting a more selective, quality-focused approach to purchasing habits. Consumers appear to be waiting longer between purchases, but when they do buy, they are choosing higher-spec replacements – reinforcing the idea that perceived value, rather than just price, is driving decision-making.

Cardlytics Analysis

In the household sector, the rules of engagement have changed. Big-ticket spending is cooling, but our data shows that consumers are still willing to invest when they feel the value is tangible, especially on higher-spec replacements in categories like electricals.

Cashback rewards are proving particularly effective in this space, encouraging considered purchases while reinforcing the idea of getting more for less. Retailers focused on affordability are outperforming their lifestyle-led counterparts.

The signal from consumers is clear: value and functionality matter more than non-essential or lifestyle-led propositions. Brands that demonstrate they understand their customers’ priorities - and reinforce that through personalised offers and targeted cashback - will go further in earning loyalty and driving conversion.

Case Study

A leading DIY brand and CDLX partnered to improve incremental sales, drive new customers and repeat visits as well as deepen loyalty with existing customers. Using CDLX’s proprietary purchase intelligence data, the campaigns identified and targeted customers with personalised value-driven offers.

Over the six-week period, over £800k in incremental sales were driven. The brand has seen 39% of campaign customers return to shop again, and captured 60% share of wallet from key competitors during that time.

Navigating a more cautious consumer landscape

Our analysis for the first four months of 2025 painted a clear picture of an increasingly value-conscious consumer. While there were bright spots — such as sustained demand for affordable luxuries and resilient online grocery growth — the broader retail environment showed signs of growing caution. The data indicated that a softening in consumer confidence could be on the horizon — something that recent retail sales figures from May have now confirmed, with sharp drops in sales linked to rising inflation and consumer cutbacks.

The opportunity for brands lies in how they respond. Our data shows that personalisation, value-driven propositions, and transparent rewards are more important than ever. Shoppers are still spending, but they are making deliberate choices about where they see true value. Cashback rewards and tailored offers can play a crucial role in reinforcing loyalty and driving conversion during this period of increased scrutiny.

For retailers, the message is clear: relevance, value, and trust must be at the heart of every interaction. Businesses that consistently prove they can deliver meaningful value at the right price will be best positioned to secure customer loyalty and drive sustainable growth in the uncertain months ahead.

Airlines: Unpacking the State of Customer Loyalty

Introduction

Previously, Cardlytics defined loyalty as a consumer’s preference for a merchant over its competitors.* We analyzed billions in spending across six industries to measure customer loyalty and spending patterns with both loyal and non-loyal customers.

But customer behavior isn’t fixed—customers shift between loyalty segments over time. Understanding these shifts helps identify churn and informs strategies to nurture relationships and move customers to higher loyalty segments. In our Loyalty Movement Report, we dive into the Airline category to better understand engagement over time by analyzing more than £40B in consumer spend behavior.

.png)

Findings:

We looked into purchase data at all Airlines in the UK over the last 8 quarters (Q1-23 through Q4-24) on a quarter by quarter basis to see whether even the “most loyal” customers showed changes in their purchase behavior.

Segment Movement

.png)

Of the portion of each customer segment that is non-lapsed, those that are loyal to a specific airline show the strongest brand retention - 31% remain loyal quarter over quarter. In contrast, Tied and Prefer customers demonstrate greater variability in behaviour, with only 4% and 12% respectively maintaining their previous preference.

Loyal customers tend to remain consistent in their airline choice, likely driven by the strength of airline loyalty programmes and exclusive incentives. However, Tied and Prefer customers show clear signs of behaviour fluidity, highlighting a key opportunity for targeted campaigns to drive conversion toward brand loyalty.

Lapsed behaviour is high across all segments—65% of previously loyal customers lapsed, and similar rates are observed among Tied (63%) and Prefer (67%) segments. This reflects typical airline purchasing patterns, where customer loyalty can be disrupted by pricing, availability, or external factors, regardless of prior loyalty classification.

Airlines Leaky Bucket

Airlines are acquiring new customers yet even more existing customers are moving into the lapsed tier. This cycle is expected based on typical consumer behavior for airline travel quarter over quarter but reinforces need to nurture existing relationships.

.png)

Takeaways:

Airline marketers’ inherent focus on nurturing loyal customers is well-know and consumer spend data show it’s working - Loyal customers tend to stay loyal. But huge opportunity exists with customers who are not loyal to any specific airline and could be lured through greater incentives. To stay top of mind, marketers must continuously nurture relationships, understand customer needs, and offer seamless experiences. To foster loyalty with your customers, consider these recommendations:

- Use an “always on” strategy to keep customers engaged, regardless of purchase frequency.

- Regularly update/refine customer segments and adjust reward offers to keep them engaged.

- Use targeted campaigns to boost loyalty and revenue.

Cardlytics can deliver a comprehensive Customer Loyalty Analysis with insights into customer behavior and movement across defined loyalty segments. Contact us for more details.

Get in touch

Need additional information or have a question? Tell us a little bit more and we’ll respond shortly.